|

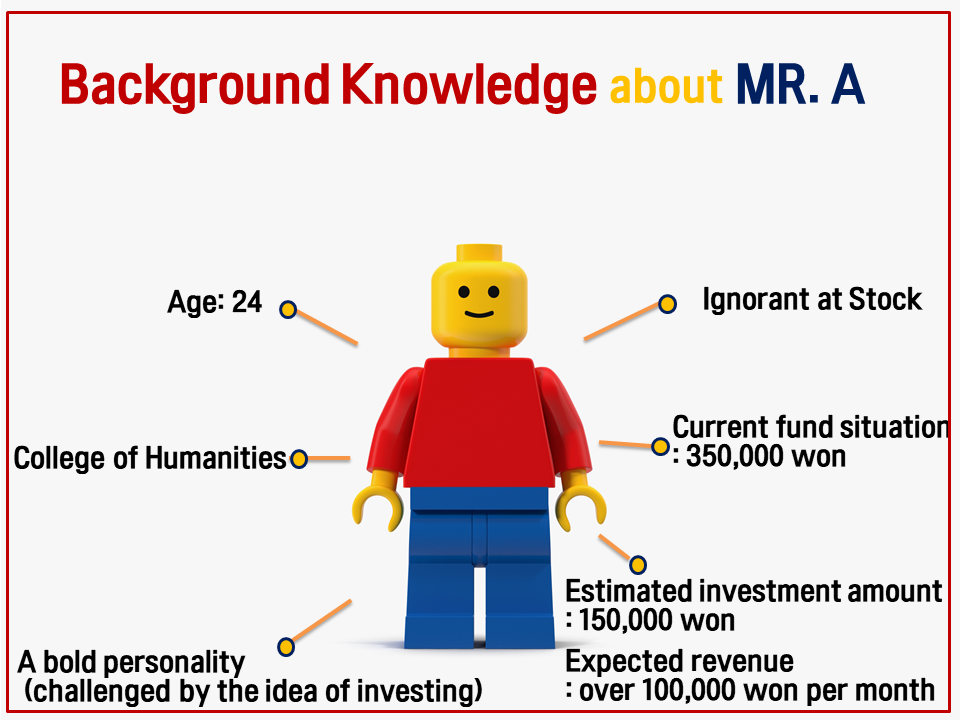

Many students may think that investing is not the wisest use of their own money or they may have experienced dangerous short-term investments through virtual currencies or long term slow return investments such as blue-chip stocks, but there are few who can say they made a lot of money. The Dankook Herald (The DKH) surveyed the investment status of our university students. We found that almost 35% of respondents had experience investing in stocks, but only 18.2% of them said they really understood the process. In other words, students were not aware of the structure of the stock market when they were investing. Also, 58% of respondents had no experience in investing, but said they were willing to take up the challenge. Therefore, the DKH has some investment tips we gathered from an interview with Professor Shin Dong-ryung in the Management Department at Dankook University (DKU) to help Dankookians (students of DKU) make successful stock investments. For the purposes of clarity, the DKH uses a fictional character, known as Mr. A, for its interview with the DKU Financial Club, in order to increase situational understanding.

|

[Story of Mr. A]

Dankookian, Mr. A, was eating with a senior who told him he earned 2 million won in profit off a 3 million won investment he made while he was in the military service. Seeing that his senior managed stock investments on his cell phone, Mr. A felt like his senior was a great role model. Mr. A decided to make some legal and exciting investments of his own, while his close friends lose big money on Bit coin or illegal sport gambling.

|

| ▲ Professor Shin Dong-ryung in the Management Department at Dankook University. |

[Advice offered by Professor Shin]

Q: Mr. A doesn’t know how to deal with stocks and what principles run the stock market. What does he have to learn before he starts investing?

A: Investors have to know what investment means, how to invest and the how the stock market works before buying in. First, the definition of investment: This is the act of committing money or capital with the expectation of obtaining an additional income or profit. For stock investment, it is essential to know how to get extra money without losing any. Second, we need to know how to invest. We can purchase individual stocks directly or we can invest indirectly through deposits to mutual funds which are managed by professionals. It is ideal to choose a method of investment according to your own tendencies and goals. Third, you need to know how the stock market works before you make an investment. You need to prepare money for investment, set up an investment policy, complete a security analysis, investment and performance evaluation.

Q: How about Mr. A's investment plan?

A: Mr. A's has made some common mistakes, which can be problematic.

Issue 1: Set an investment limit without considering the feasibility.

There is no ideal amount to invest, but in my opinion, students can save money from their part-time jobs and invest between KRW 150,000 and KRW 200,000 a month. Investors need to consider their financial situation before making any investment.

Comment: If you invest KRW 150,000 a month in an index fund, KODEX 200 (the latest monthly return rate of 0.7%), you can make KRW 28,062,822 after 10 years.

Issue 2: Has an excessive revenue target.

Mr. A's investment’s design problem is that he plans on investing about 150,000 won per month and earning about 100,000 won off that investment. In order to make that kind of return, his investment target would have to be raised by 70% per month, which is too high. The annual average return on Korea's stock market is about 8% per annum. If your investment objective is unrealistic, you will always be following high-risk, high-return investments and you may lose all of your money due to this excessive focus on short-term trading.

Comment: When you start out with the same income as Mr. A, aim for an 8% annual rate of return off the composite index and if you want to be a little more optimistic, open up to 12% (1% a month).

Issue 3: Too short a retention period

We often see articles about people "who raised hundreds of % of revenue in the short term," on the internet leading students to be impulsive and follow them with risk associated investments. Nevertheless, in most cases, this kind of strategy is likely to fail if you pay a lot of transaction costs. For example, famous investor Warren Buffett suggests that stock investments are likely to succeed in the long run, which means that the periods of non-return or loss-loss equity investments are in the very short term, so it’s difficult to predict a period of great profit.

Comment: The more long-term hold you have from buying blue-chip stocks when the price is low, the more opportunities you get to earn big profits.

|

Q: Mr. A does not have specific company in mind to buy stocks from, so he is just trying to choose a blue chip company. What do you think?

A: There are valuations of investments you have to be sure about. Among them, are the PER (price to earnings ratio) and the PBR (price to book-value ratio). When the PER or PBR is lower than the industry average or that of their competitors, the stocks are considered undervalued. This information can be found on the Korea Exchange (www.krx.co.kr) or the Financial Supervisory Service's electronic disclosure system (dart.fss.or.kr). Securities can be easily identified through the portal on (http://finance.naver.com).

Comment: It is important to find a "good sport", but choosing a "good buying time" is more important for raising revenue.

Q: What do we have to track after we have made an investment?

A: You have to confirm the numbers that the company has made public. Read the annual report and quarterly report which contain the company’s financial statements, and check how much things have changed, including the sales of company, their operating income and debt liquidity. Moreover, you have to focus on all sorts of economic news, the change in the nation’s macroeconomic situation such as interest rates, currency valuation, oil prices, the financial situation of a government and so forth.

Comment: One good thing about a small sum investment in stock is that it makes people interested in how the economy and companies work, something you should check out too.

Q: What should you do after your investment has ended?

A: Evaluating investment performance is very important. It will be better if you compare yours with KOSPI, KOSPI200, or KOSDAQ’s price indexes of stocks during the same period, rather than with commercial banks interest rates. Whether your revenue comes from good luck or not, don’t be overconfident about yourself. It is good to recognize that it is through your endeavors that you saw huge stock gains and bought them at low prices making profit as result of storing them over the long term, without being shaken by short-term market changes. Therefore you need to assess your investment results calmly and supplement any weaknesses as needed.

Q: What would you like to say to students interested in investing in stocks?

A: The most important thing is to only use surplus funds. Since the stock market is highly volatile, short term investment loss can easily happen. Diversification of your stocks is important as well. If you invest directly in individual stocks, you can reduce the risks of individual stock volatility by spreading investments over four or five different industries. The last thing I want to emphasize for Dankookians is that the best investment is to invest in which can enhanced your own values. If there is a student who invested millions Won in a particular stock and as a result, spends their days looking at the smart phone screen to see how the stock is changing, it will adversely affect your start to investing. I want to tell students to try not to invest in stocks directly, but leave your money with mutual funds or interest in an index fund, so that you can use your precious time more effectively.

윤진현, Jane Shcak, 김동은, 박근후 dankookherald@gmail.com

![[Campus Magnifier] Let's Surf the Library!](/news/photo/202404/12496_1765_4143.jpg) [Campus Magnifier] Let's Surf the Library!

[Campus Magnifier] Let's Surf the Library!

![[Campus Magnifier] Let's Surf the Library!](/news/thumbnail/202404/12496_1765_4143_v150.jpg)