With the recent passing of Samsung president, Lee Gun-hee, inheritance taxes have been a hot topic in the news. An Inheritance tax is levied on an heir as a result of earning property or monies after the death of the person bequeathing the assets. In Korea, when a spouse inherits assets less than 1 billion won, there is no inheritance tax levied. However, if the asset holder did not have a spouse, the heir of an inheritance valued under 500 million won, pays a nominal tax rate that is in line with the rest of the world. More specifically, for assets valued below 100 million won, the heir to the holdings pays 10% of their estimated value and 20% for assets valued under 500 million won. However, for assets valued under 1 billion won, the heir must pay 30% of the assessed value, and 50% for assets above 3 billion won. In my opinion, Korea’s inheritance tax system is excessive. There are 3 reasons for my opinion; inheritance taxes are being abolished around the world, they hamper corporate succession, and it is a form of double taxation.

|

| ▲ National petition requesting to remove Samsung's inheritance tax. (Photo from Blue House Petition) |

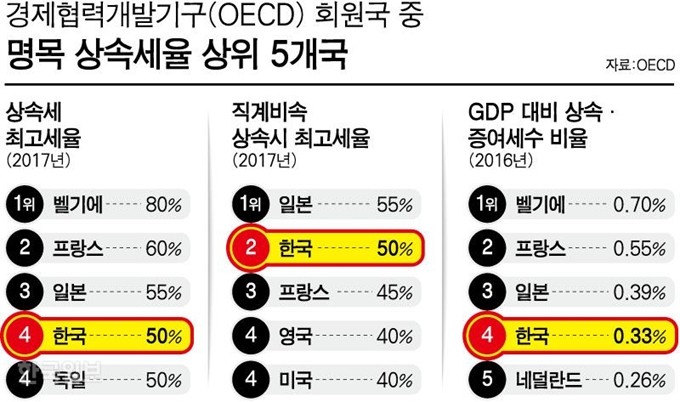

Inheritance taxes are being abolished all around the world. 15 member states in the OECD have already gotten rid them. In contrast, Korea maintains the second highest rate for inheritance taxes in the world at 50%, while Japan’s inheritance tax rate is 55% and France is 45%. The USA and UK are at 40% while Germany is only 30%. China has no inheritance tax and the Czech Republic abolished the tax in 2014. Austria repealed the tax in 2008 and Canada abolished it in 1971. Australia and Mexico each revoked the punitive tax in 1979 and 2005 respectively. In fact, over one-third of OECD states abolished or never introduced an inheritance tax. Canada, the first OECD state to rescind the tax, shifted to a capital gains tax system. The reason is that the political cost of maintaining inheritance and gift taxes were too high for the rate of return. Different countries have different reasons for abolishing the tax, but overall it was found that the tax hampers consumption, savings, and investment. Also, many countries believed that the abolition of the tax would revitalize local economies through increased production, employment and the accumulation of capital. Together these factors would contribute to an increase in tax collection in the long-term.

|

| ▲ Top five countries in inheritance tax rate. (Photo from HanKyung) |

An inheritance tax can be a big blow to the donor’s chosen successor. The punitive tax is forcing heirs to abandon their rights to manage companies they inherit to avoid paying the excessive levy. For instance, in 2008, a successor who inherited the majority shares in Three Seven (777), a nail clipper manufacturer, was forced to dispose of their stake in the company because of the inheritance tax burden. The world’s number one condom producer Unidus was forced to hand over the family’s management authority to a private equity firm in 2017 and Rock & Lock the number one manufacturer of sealed containers was also forced to sell its stake to a Hong Kong based private equity firm in 2017. In other words, the inheritance tax kills small and medium sized business succession. Conglomerates like Samsung might be able to find ways to manage the payments and schemes to avoid the excessive penalties, but smaller companies cannot. To eliminate this unfair obstacle to corporate succession in the short term, Korea’s punitive inheritance tax, which is set at 50%, should be reduced into 25%, a number more in line the average of OECD states. However, the long-term objective should be to abolish it in favor of a capital gains tax.

Finally, an inheritance tax is like a gift tax except it is double taxation. A gift tax is imposed on assets transferred while the donor is still living. Many people opt to pay gift taxes to avoid the excessive inheritance taxes. There is a deduction limit for gift taxes, but if the donor transfers the assets gradually over time, the person inheriting the holdings can avoid the blow of an excessive inheritance tax burden. An inheritance tax is akin to double taxation as the donor already paid tax on these earnings. Simply transferring ownership to someone else should not be taxable as it is not earned income it is merely transferred income.

I disagree with the imposition of inheritance taxes for the reasons I have outlined. They are outdated laws that are being abolished around the world; they are a big blow to companies that hope to choose their own management successor, and while they are similar to gift taxes, they are a form of double taxation. Many people are trying to avoid paying excessive inheritance taxes by opting to gift their assets instead, but this is not always the best solution for the donor or the heir. There are many reasons this form of taxation is considered excessive and punitive, especially for small and medium sized companies, so I believe, it is in our country’s best interest to see them abolished as soon as possible.

정소연 dankookherald@gmail.com

![[Campus Magnifier] Let's Surf the Library!](/news/photo/202404/12496_1765_4143.jpg) [Campus Magnifier] Let's Surf the Library!

[Campus Magnifier] Let's Surf the Library!

![[Campus Magnifier] Let's Surf the Library!](/news/thumbnail/202404/12496_1765_4143_v150.jpg)